Buying a home is one of the most significant financial decisions you’ll ever make, but the process...

7 Ways to Protect Your Home From Flooding

If you are a homeowner, you have a lot of potential damage to keep your eye out for. While fire, earthquakes and theft might all be causes for concern (depending on where you live), you also need to think about flood damage.

It’s no secret that floods can be incredibly destructive. Not only can an influx of water ruin your valuable possessions in an instant, it can rot and destroy the structure of your home itself. People who live in areas prone to flooding often have major structural damage to contend with for years after the initial waves of water enter their dwelling.

The after effects of flood damage mean that you could be putting your family’s health at risk for years to come. The mold, mildew and other toxins that often result after significant water damage could all negatively affect your wellbeing and safety. Is it worth the risk?

-

Assess the Risk

Before you can truly assess the risk of flooding, you need to assess whether the area in which you live is prone to floods. To help you do so The Federal Emergency Management Agency (FEMA) provides an online map which details the risk factor of your home’s area.

If you find that your home is in an area with significant flood risk, take some time to take precautions and implement all of the damage prevention measures you can. Hopefully these measures will never be necessary, but if your home is flooded you’ll be incredibly relieved that you took them.

As the old saying goes, “a stitch in time saves nine.” Imagine how many ‘stitches’ you would need to make if a flood destroyed your home – making some minor, cost-effective proofing measures now is a much better strategy.

Once you have assessed your property and surrounding area, it is time to start taking some flood proofing measures in and around your home. These points are simple to do, affordable and fast – and if and when a flood does occur, you will be eternally grateful that you made them.

-

Install a Sump Pump

A flooded cellar or basement can be an utter disaster if you have no way to remove the accruing water. Watching it rise and rise can be heartbreaking, but if you easily. The average cost to install a sump pump ranges from $550 to $1,100 depending on if have a sump pump installed, you can switch it on and begin the process of removing the water quickly and on the size of the pump.

-

Get Your Hands on Some Sandbags

Your local government should have some sandbags to give away for free, or you can approach a construction supplier to buy your own.

-

Cover Your Air Bricks

Purchase covers for your air bricks to prevent streams of water from entering your structure.

-

Add Non-Return Valves to All Your Drains and Pipes

Non-return valves will prevent sewage and other effluence from flowing back into your drains and toilets.

-

Raise Your Household Appliances and Electronics on Plinths

Raising your expensive electronics and appliances off of the ground will protect them if a few inches of water rushes into your home.

-

Consider Moving Your Electrical Sockets up a Foot or Two

While this might be costly, if you move your electrical sockets up higher on the wall, they are less likely to be damaged in the case of a flood.

To Insure or Not to Insure?

When it comes to flood insurance, a lot of people view it as an optional add-on to their homeowner’s policy. After all, for the cost of 10 years of insurance premiums, surely it must be cheaper to set some money aside in the case of a flood?

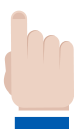

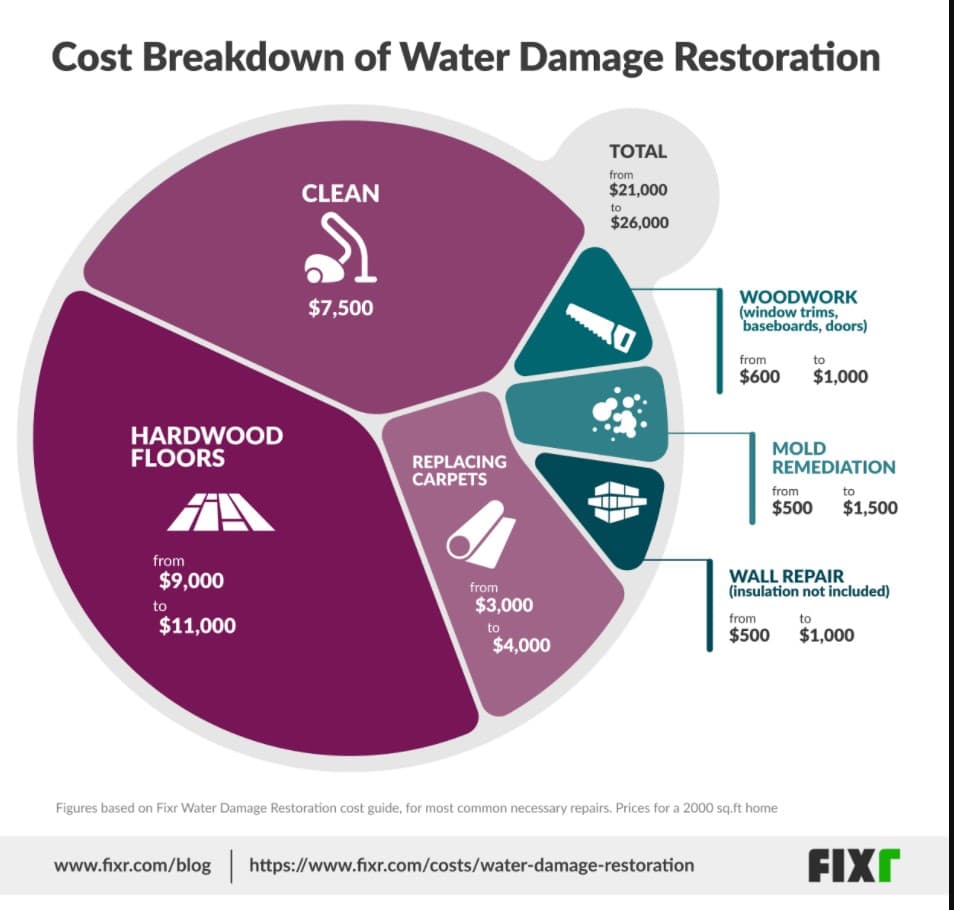

A recent report by Fixr compares the average cost of insurance versus the cost of recovering from just one flooding incident. While the costs of flood insurance are higher in certain areas (such as the Northeast), the cost of flood damage in flood-prone areas can be catastrophic.

Fixr estimates current average water damage restoration costs at between $22,000 to $26,000. Average annual flood insurance in the U.S. (as of 2018) ranges from $544 to $1372 according to ValuePenguin.

For homeowners whose houses are in areas associated with a low flood risk, the decision to insure their homes against flood damage is ultimately up to the individual owner. But for those whose homes are located in an area with significant flood risk, insurance is surely the better financial choice.

As you can see from the figures above, the cost comparison is clear. If your home is in a high-risk area, paying to flood proof your home and taking out insurance now can save you time, headache, grief and most of all – money.

___

By Yuka Kato, Content Manager of Fixr.com